American General Life Companies AGLC101796-ME 2010-2024 free printable template

Show details

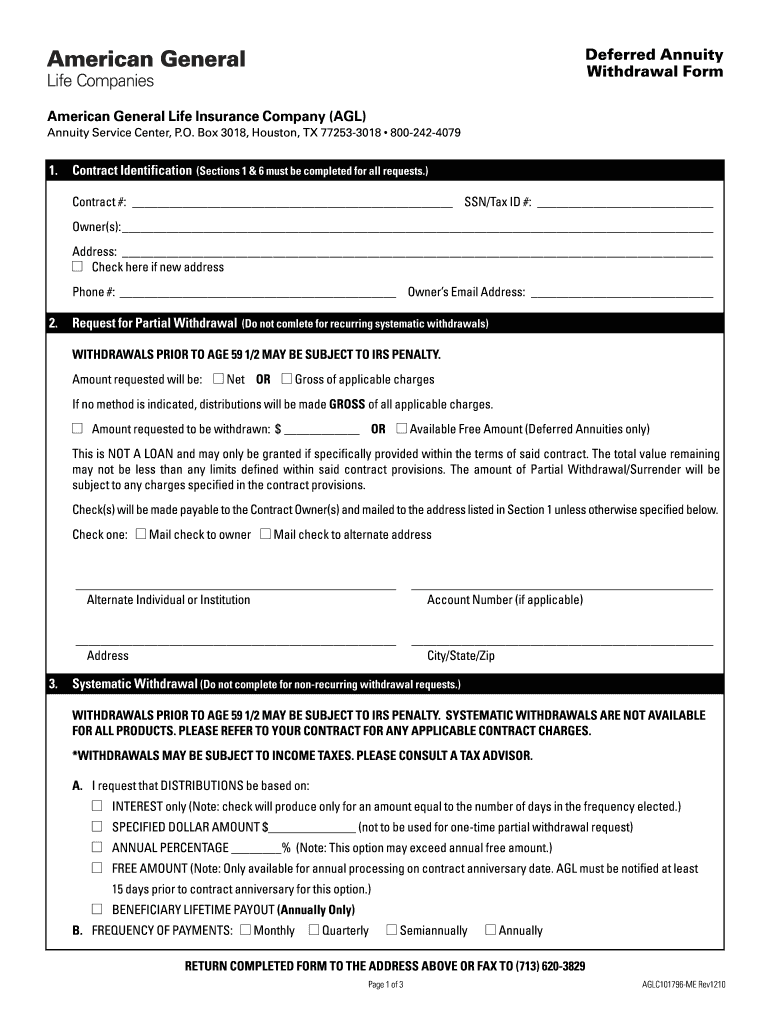

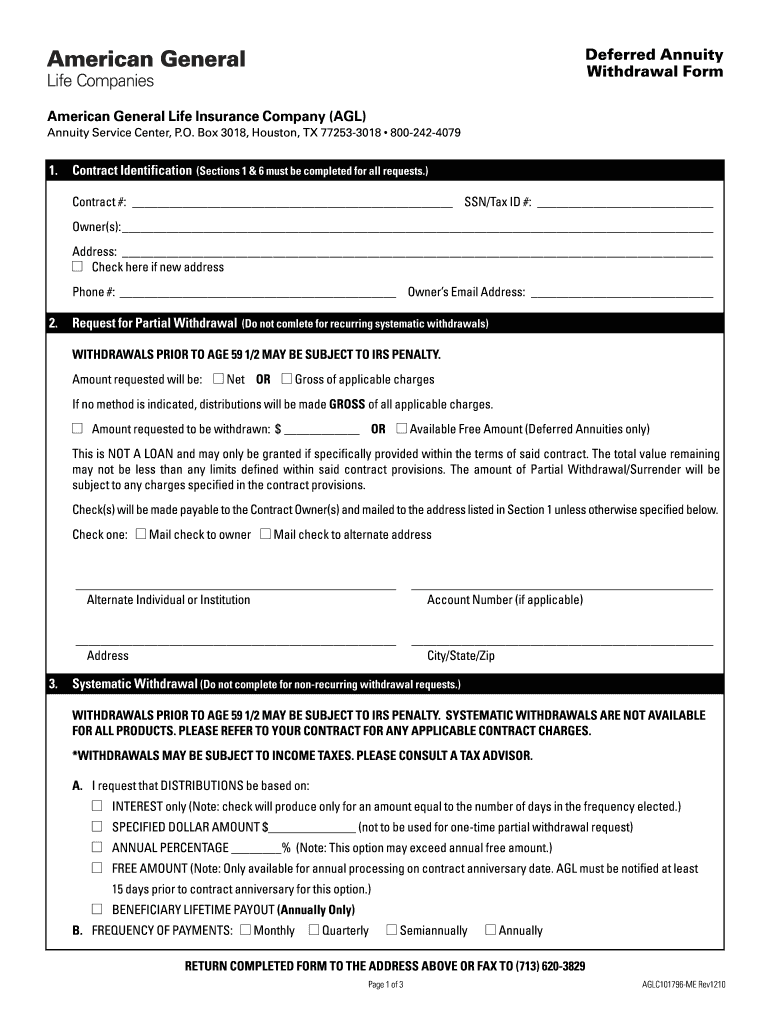

Deferred Annuity Withdrawal Form American General Life Insurance Company AGL Annuity Service Center P. FREQUENCY OF PAYMENTS Monthly Quarterly Semiannually Annually RETURN COMPLETED FORM TO THE ADDRESS ABOVE OR FAX TO 713 620-3829 Page 1 of 3 AGLC101796-ME Rev1210 C.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your aig annuity withdrawal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aig annuity withdrawal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aig annuity withdrawal form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit aig fixed annuity withdrawal form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out aig annuity withdrawal form

How to fill out AIG annuity withdrawal form:

01

Gather necessary information: Collect all relevant details, such as your name, policy number, contact information, and any required supporting documents or identification.

02

Review the form: Carefully read through the AIG annuity withdrawal form to understand its sections and requirements. Familiarize yourself with any specific instructions or guidelines mentioned.

03

Complete personal details: Fill in your personal information accurately, including your full name, address, phone number, and email address. It is important to provide the information exactly as it appears on your policy documents.

04

Specify withdrawal details: Indicate the amount you wish to withdraw from your annuity. Include any additional instructions regarding the disbursement method or tax withholding preferences, if applicable.

05

Provide beneficiary information: If you want the funds to be distributed to a beneficiary, provide their complete details, including their name, address, phone number, and relationship to you.

06

Sign and date: Once you have reviewed the form and filled in all the required information, sign and date the form to authorize the annuity withdrawal.

Who needs AIG annuity withdrawal form?

01

Policyholders: Individuals who have an annuity policy with AIG and wish to make a withdrawal from their annuity account will need the AIG annuity withdrawal form.

02

Beneficiaries: In case a policyholder passes away, the designated beneficiary may need to submit the AIG annuity withdrawal form to request the distribution of funds from the annuity.

03

Financial advisors: When assisting clients who have AIG annuity policies, financial advisors may need to obtain and complete the AIG annuity withdrawal form on behalf of their clients.

Fill aig annuity surrender form : Try Risk Free

People Also Ask about aig annuity withdrawal form

What is an annuity withdrawal form?

How do I withdraw money from my annuity?

What is the best way to take money out of an annuity?

How do I withdraw money from an annuity?

How do I withdraw money from my AIG annuity?

Can you take monthly withdrawals from an annuity?

Can I withdraw money from my AIG retirement account?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is aig annuity withdrawal form?

The AIG Annuity Withdrawal Form is a form that allows an annuity holder to withdraw funds from their annuity. The form requests information such as the annuitant's name, address, Social Security number, and details of the amount of money to be withdrawn. The form must be signed and dated in order to be processed.

Who is required to file aig annuity withdrawal form?

Anyone who wishes to withdraw money from an AIG annuity must complete and submit an AIG annuity withdrawal form. This form is available from AIG's website or by contacting AIG directly.

What information must be reported on aig annuity withdrawal form?

The information that must be reported on an AIG annuity withdrawal form includes the name of the policyholder, the policy number, the amount of the withdrawal, the beneficiary name, the Social Security number of the beneficiary, the bank information for the direct deposit, and the signature of the policyholder.

How to fill out aig annuity withdrawal form?

To fill out an AIG annuity withdrawal form, follow these steps:

1. Obtain the withdrawal form: You can usually find the form on the AIG website or by contacting their customer service team.

2. Provide personal information: Fill in your personal details such as your name, address, phone number, and social security number.

3. Account information: Enter your annuity contract number and policyholder information, including the owner's name and date of birth.

4. Choose withdrawal type: Indicate whether you want to take a partial withdrawal, full withdrawal, or systematic withdrawal.

5. Specify withdrawal amount: If you are requesting a specific dollar amount, carefully fill in the desired withdrawal amount. Otherwise, input the percentage or number of annuity units to be withdrawn.

6. Tax withholding: Indicate whether you want federal income tax withheld from your withdrawal. If so, specify the percentage or dollar amount to be withheld.

7. Signature: Sign and date the form to certify that the information provided is accurate and that you agree to the terms and conditions related to the withdrawal.

8. Submission: Send the completed form to AIG either by mail or through their online portal, as instructed on the form or by their customer service team.

What is the purpose of aig annuity withdrawal form?

The purpose of an AIG annuity withdrawal form is to request a withdrawal from an annuity contract with American International Group, Inc. (AIG). An annuity is a financial product that provides regular payments to an individual during retirement or a specified period of time. The withdrawal form allows annuity holders to access a portion or the full value of their annuity investment, typically in the form of a lump sum or periodic payments. The form acts as a request for AIG to disburse the desired funds from the annuity account according to the individual's instructions.

How can I send aig annuity withdrawal form for eSignature?

To distribute your aig fixed annuity withdrawal form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I get aig partial withdrawal application?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the general annuity withdrawal form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I execute general annuity withdrawal online?

pdfFiller has made it simple to fill out and eSign aig annuity withdrawal forms. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Fill out your aig annuity withdrawal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aig Partial Withdrawal Application is not the form you're looking for?Search for another form here.

Keywords relevant to american general life insurance withdrawal request form

Related to american general annuity withdrawal form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.